Ever talked to your accountant about setting up a family trust?

If so, you might have noticed that they suddenly got a spring in their step; others may have leant back in their chairs with great confidence and rattled out some babble that sounded like a foreign language.

If you can rise above that “noise”, setting up a family trust has some distinct advantages for small business owners.

Here we consider why you might want to do that and how to go about it…

Setting up a family trust: Why would you consider it?

Without getting bogged down in the definitions, let’s consider the main purposes of family trusts. These are generally two-fold:

- Wealth protection: the ability to separate assets (shares, units and other investments) from the risk that a business or individual may be linked too.

- Tax effectiveness: the ability to pass on business profits in the most tax-effective manner.

From a wealth protection aspect, say that you’re a small business owner who is sued as a result of an unexpected event: you’re at fault in a car accident that’s not covered by insurance or the Deliveroo driver trips on the crack in your driveway and breaks their arm.

Your wealth, including property and shares of your own company, are potentially left exposed.

However, if you set up a family trust correctly, the business can be protected.

Setting up a family trust for wealth protection and tax effectiveness

We find that family trusts are able to best protect wealth and be tax effective for business owners when:

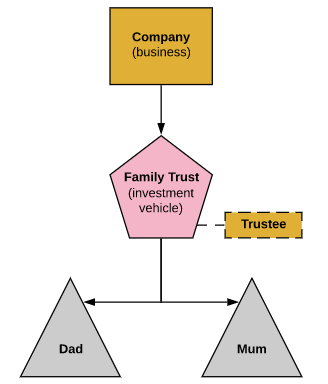

- The business operates from a trading company and the shares are owned by a family trust; or

- The business operates directly from family trust.

Unfortunately, however, many small businesses are unable to utilise the tax advantages of this system. They’re not profitable and not intended to be a saleable asset. Profit is required when distributing from family trusts.

Regardless, the wealth protection factor remains very beneficial to all business owners.

The above is best illustrated by looking at a couple of examples…

Example 1: A business operating from a trading company, with shares owned by a family trust:

- Company profits (dividends) are paid to the shareholding trust. Now the money is sitting in the trust’s bank account.

- The money comes out of the family trust bank account and this payment is named a ‘distribution’.

- The trust is not fixed, which means that the distributions do not have to be paid out in a set manner; they can be discretionally paid to any named or default beneficiary that the trust deed permits.

- The beneficiary might be a non-working member of the family, whose income is much lower; this results in less tax paid, leaving more money in the family pocket to spend or save.

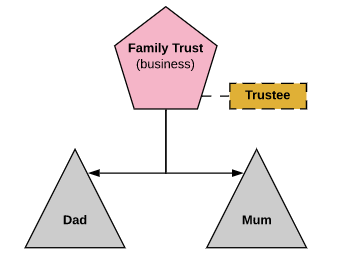

Example 2: The business operates directly from a family trust

- The business makes a profit and, since it’s less desirable to retain profit in the trust (that’s a chat for another day), the distribution is paid according to the trust deed.

- In the beneficiary’s hands, less tax is paid, leaving more money in the family pocket to spend or save.

The “less tax” benefit of setting up a family trust

How does this whole “less tax” thing work?

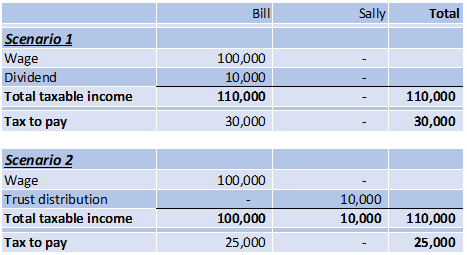

In a very simple example below, meet husband and wife, Bill & Sally:

Bill and Sally can be paid trust distributions.

Why? Because there are profits from the business and the trust deed allows it.

- In Scenario 1, Bill earns gross taxable wages of $100k, and the structure is not set up with a trust. Bill owns all the shares in his trading company with $10k profit paid as a dividend. This year, Sally earns nothing and doesn’t actively participate in the business.

- In scenario 2, it’s identical except that a family trust owns the shares of the trading company. The company has $10k profits to pay out through the trust and it decides to pass all to Sally (nothing to Bill).

In scenario 2, a tax saving of $5k is achieved… and this is in just one of the years the trust tax effectively distributes profits.

Note that the above scenarios show all or nothing to each beneficiary. The trust is discretionary so it can distribute in any proportion.

FAQs about setting up a family trust

Is it recommended that a family trust sets up a bank account?

Yes, having a bank account showing receipt of income, expense payments and paid distributable profits makes life easier for everyone.

Most often, the name of the bank account is the trustee(s).

Who lodges a tax return, the trust or the trustee?

In most cases, the trust should lodge the tax return. This means the trust will have registered for a Tax File Number and, in the case of a business, an ABN.

Who can be a beneficiary (i.e. who can money be effectively distributed to)?

Always refer to the trust deed. However, generally speaking, it is broad and extends to immediate family and most indirect family members.

The deed can also include related companies and trusts.

If you already have a trading family trust, should other assets be owned in the same family trust structure?

They can be but it is mixing exposed risks with assets. If litigation arises, it is best that they are kept separate, in which case a second or third family trust can be established.

Got more questions about setting up a family trust?

Always ask an accountant who is experienced in setting up family trusts as mistakes can be costly.

Feel free to contact us here with questions.

Hi There

I am looking to open a family trust as I am buying shares in a franchise.

Could you please let me know the costs involved and the timeframe?

Thanks so much

Claire

Hi Claire,

Thank you for your comment! We have since reached out to you.

Kind Regards,

Eagle Financial Pty Ltd