Does your accountant say your business made a profit at the end of the year? But when you look in the bank, the profits are never there?

Then comes the tax bill…

You and your accountant are speaking two different languages. That’s why there’s a difference between profit and cash held.

You’re looking at it from a cash basis (bank balance) and your accountant is talking from an accounting basis.

There’s no right and wrong. It depends on the context as to which is more suitable.

Below we look at a number of different scenarios that create a difference between profit and cash in a business.

The difference between cash and accrual basis

Let’s start with the basics:

- Cash basis reports events when the money comes in or goes out of your bank account.

- Accruals basis reports when the income or expense is created but you are yet to receive the money from your client or pay the bill (amongst other things).

Your accountant refers to accruals basis because the majority of businesses report this way to the ATO for income tax purposes.

As a small business owner, you’re most likely looking more regularly at the bank account.

Understanding this difference is the first step to understanding why there may be a difference between profit and cash in your business.

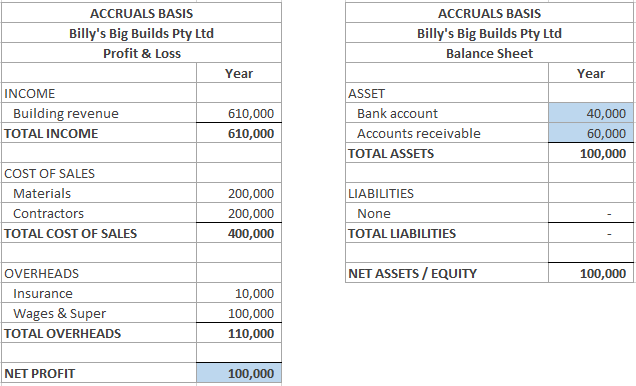

Difference between profit and cash in the bank: an example

Your business has a profit of $100,000 shown in a Profit and Loss statement but only has $40,000 cash in the bank.

The $60,000 difference is commonly found in the Balance Sheet.

$60,000 is waiting to be paid by a client as you’ve sent an invoice to them but they haven’t yet paid it.

This client invoice lifts profit by $60,000 but there is no cash to show for it.

TIP: Ensure your business is effectively managing client payments. Most industries are rife with late paying clients. Ignoring this is not an option.

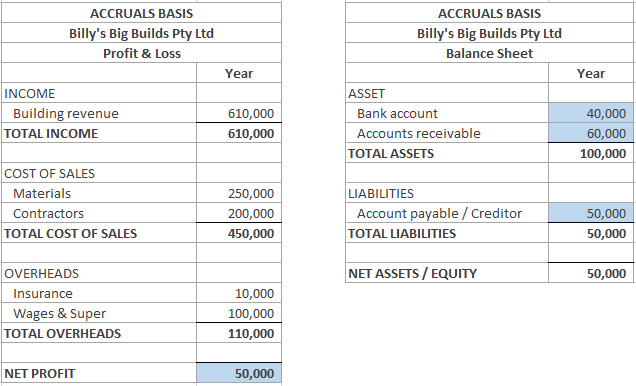

What happens if you receive a supplier bill before the reporting date and you haven’t yet paid it?

Let’s now assume that a supplier presents you with a bill for $50,000 just before the reporting date.

On an accruals basis:

- The bank account hasn’t moved because you haven’t paid the bill.

- Profit has reduced by $50,00, given the materials expense has increased by that amount.

- Your accounts payable/creditor (liability) has increased by the full $50,000.

In this updated example, you see that you are owed $60,000 from your client but also owe $50,000 to a creditor:

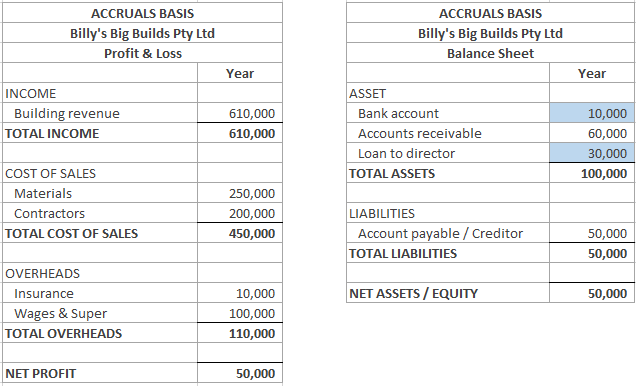

What happens if you withdraw cash from the business?

Another common impact on your cash flow are loans that you have made or have taken from the business.

Say you now draw $30,000 from the bank but it is not a regular wage payment, just a loan.

The cash is gone but the profit hasn’t changed so you have another situation where there is a difference between profit and cash held:

TIP: It’s very tempting to withdraw cash when it’s sitting in the account. It’s always best to talk to your accountant to check that the business can afford the additional withdrawal.

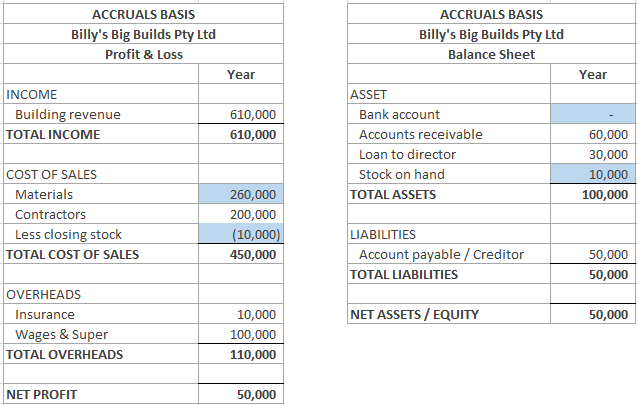

What happens if you buy stock in the business?

Buying stock in the business is another way to create a difference between profit and cash.

Most people would consider that buying materials for $10,000 to be used for jobs over the next few years would be seen as an immediate expense.

Given that these materials are still in storage and not yet used on a job, they are considered stock and not a deductible expense.

So, on the accruals basis:

- The materials expense has increased by $10,000.

- Another item has appeared in the Cost of Sales named “closing stock”, as a negative amount as none of the materials have been used (stock is added back until used).

- Total ‘Cost of Sale’ and ‘Net Profit’ haven’t changed.

- The bank account has reduced by the $10,000 paid for these materials/stock, leaving no more money in the account.

- The cash is gone, profit unchanged and a new item is on the balance sheet: ‘Stock on Hand’.

TIP: Don’t over-invest in stock as this can put significant pressure on business cash flow.

What if you buy a large piece of machinery?

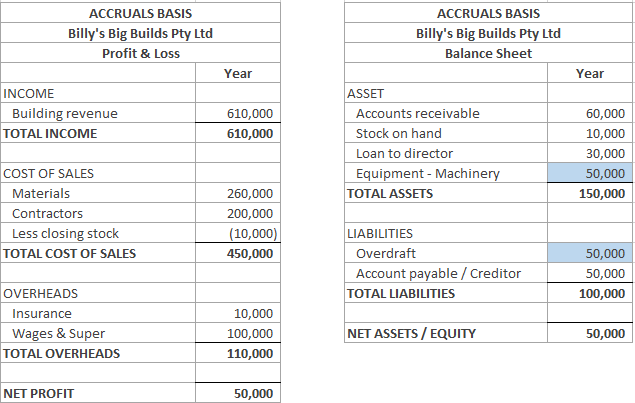

Say the cost of a new piece of machinery is $50,000. This moves the business into overdraft:

- The business owes the bank $50,000.

- It has ‘Equipment – Machinery’ sitting on the balance sheet.

- Profit hasn’t changed but the bank account is looking less than healthy.

TIP: If you don’t want the large cash outlay, consider financing the equipment instead. It will be depreciated in the years to come, reducing the profit each time without additional cash outlay.

Understand accruals basis reports to explain the difference between profit and cash held

All of the above examples are on an accruals basis.

By focusing on what these reports show, you’ll improve your understanding of business performance: this is a must for any business owner, even if you loathe the number crunching.

If you find accruals reporting challenging or require guidance on which accounting/bookkeeping software options are best for tracking everything, feel free to ask us.

We’re big fans of Xero, with its easy-to-use interface and seamless functionality. With a little trusted guidance, accruals-based reporting will become like second nature to you.

Leave A Comment