The Background story of Meals and Entertainment

A strong team culture and an effective sales process are two key ingredients of a successful business, and both can involve wining and dining. There’s coffee meetings, long lunches, dinners, functions and so on. Your prospective and existing clients (and staff) will enjoy and respond well to being treated well. You might take the team out for a celebration lunch, or an exciting new prospect out for a steak.

You can’t avoid those costs — they’re legitimately needed for the business. And they’re fun! So surely they are tax-deductible, right?

Fringe benefits – dining out on deductions

In the 1970s and 80s, long lunches were par for the course in the business community. While this was partly because businesses became adept at doing deals and winning favour at the dining table, it was also much simpler at that time to claim these as tax deductions.

It also became commonplace for employees to have their lunches regularly paid for by their employer. Quite a bonus for the staff.

In the mid-1980s, the federal government recognised they were being dudded. The businesses were claiming tax deductions for the restaurant meals, but the staff were not reporting the meal benefits as income. Rather than giving pay rises (on which the employees would be taxed and the businesses’ payroll tax, if applicable, would increase), the businesses just bought their staff more and increasingly lavish lunches!

Fighting back on the fringe

In 1986, these meals became known as “fringe benefits”, and the tax situation regarding them has been somewhat complicated ever since. Fringe benefits are “payments” – literally, benefits – made to employees in the form of something other than salary or wages. Essentially, these represented a tax loophole. After 1986, the federal government moved to close the loophole to ensure they weren’t missing out on a source of taxation. And Fringe Benefits Tax (FBT) was born.

Fringe benefits include many items other than the meals and coffee that are the focus of this article. Other items can include:

- allowing an employee to use a work car for private purposes

- giving an employee a discounted loan

- paying an employee’s gym membership

- providing free tickets to concerts

- reimbursing an expense, such as school fees

- giving benefits under a salary sacrifice arrangement.

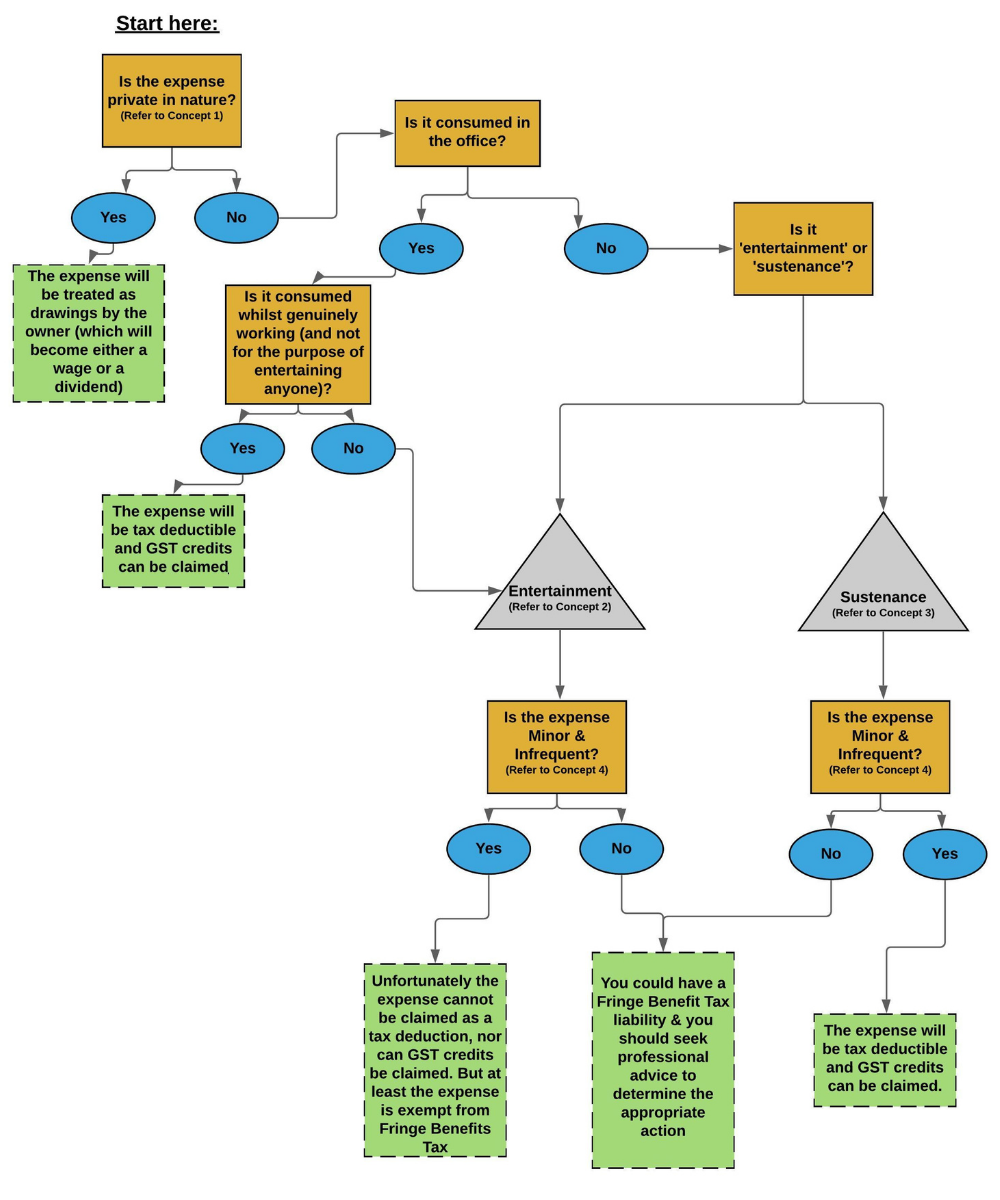

Decision Tree

Key Concepts for Meals and Entertainment

Concept 1 – Private in nature: Examples of this include:

- A business owner enjoying a meal/drink alone.

- The owner’s family enjoying a meal/drink without anyone else related to the business in attendance.

- Any meal or drink expenses of a sole-trader are considered private in nature.

Concept 2 – Entertainment: Indications of entertainment are:

- It’s a social situation where the purpose is for individuals to enjoy themselves

- A full meal is being provided (such as breakfast, lunch or dinner)

- Alcohol is provided

- Consumption is outside of work hours

Concept 3 – Sustenance: Indications of sustenance are:

- That the drinks or light meals are simply for sustenance or refreshment; they are not replacing a breakfast, lunch or dinner meal.

- The meeting is for work purposes rather than social or celebratory.

- The meeting is during normal working hours.

Concept 4 – Minor & infrequent: To apply this exemption:

- The value of the benefit must be less than $300 per employee (and per employee spouse if applicable); and

- It must be irregular and infrequent. (This would include Christmas parties and random staff recognition events.)

Learn the FBT lingo

On meals and coffee, there are several complicating concepts that determine what is and what isn’t tax deductible today. For meals and drinks, the key two are:

- Are they entertainment or sustenance?

- Is the spending minor and infrequent or not?

You certainly don’t need to be an expert on these concepts — that’s what we’re here for! Yet, if you do understand a little, it might allow you to make better decisions. Or, at least, know to speak to us before you plan certain expenditure so you won’t be caught out having to pay extra tax needlessly.

For this reason, we’ve provided a Decision Tree above, together with an explanation of these concepts.

A small business FBT example, using the Decision Tree

Meet Suzie, owner of a graphic design business that has three employees.

Her team of accomplished designers work from her leased office space in the CBD. The team gets along well, and Suzie takes everyone out for a lunch once per quarter, purely for team bonding.

Her office is nicely presented with a meeting room so her clients can visit to discuss work. At these meetings Suzie likes to offer them morning or afternoon tea.

Occasionally, Suzie will conduct performance review meetings with her staff on a one-on-one basis at the cafe downstairs. They’ll usually just buy coffees.

So, here we have three situations of ‘wining and dining’:

- Staff lunch — monthly sit-down meals with the team:

- Facts considered:

- Is the expense private in nature? No, it’s work-related.

- Is it consumed in the office? No, it’s at a restaurant.

- Is it ‘entertainment’ or ‘sustenance’? Entertainment, as it is a full meal and could not be considered merely sustenance.

- Is it ‘minor & infrequent’? Yes, it’s infrequent and assuming the cost of the lunch will be less than $300 per person.

- Tax outcome: Non-tax deductible and no GST credits can be claimed. However, it is exempt from Fringe Benefits Tax.

- Facts considered:

- Client meeting — tea, coffee and snacks purchased for in-house use:

- Facts considered:

- Is the expense private in nature? No, it’s work-related.

- Is it consumed in the office? Yes.

- Is it consumed whilst working? Yes, during working meetings.

- Tax outcome: The costs are tax-deductible and GST credits can be claimed.

- Facts considered:

- One-on-one staff meeting — coffees at a cafe for the purposes of an HR discussion:

- Facts considered:

- Is the expense private in nature? No, it’s work-related.

- Is it consumed in the office? No, it’s at a restaurant.

- Is it ‘entertainment’ or ‘sustenance’? Sustenance, as it is only a coffee and the meeting is for work purposes.

- Is it ‘minor & infrequent’? Yes, it’s infrequent and assuming the cost will be less than $300 per person.

- Tax outcome: Tax-deductible and GST credits can be claimed. It is also exempt from Fringe Benefits Tax.

- Facts considered:

Doing the FBT numbers

So, if you must pay Fringe Benefits Tax, how can it affect your bottom line? When you take an employee out for lunch, what will it cost you? Here’s a basic analysis of the cost that would apply if you did have to pay Fringe Benefits Tax for a staff lunch.

The lunch is taxed in such a way to reflect the wage you would need to pay the employee for them to pay for their meal using their after-tax wages. The rate for this calculation is 47%, irrespective of the personal income tax rate of the employee receiving the benefit.

For example, let’s say that lunch costs you $100 for the employee. If that employee were paying the top rate of 47% income tax, they would need to earn $188 in order to pay for the meal (considering the income tax they’d also have paid earlier).

Income 188

47% tax – 88

In pocket 100

Therefore, in this simple example, the business would pay $88 of Fringe Benefits Tax (in addition to having paid the $100 for the meal). There are alternative calculation methods, but we have deliberately kept this example simple. And it outlines how costly it can be to your business to have this expense. And not only that, the recording and reporting requirements for Fringe Benefits Tax add more cost to your business.

Depending on your overall meals and coffee expenditure, and how your business wants to incorporate wining and dining into your strategy, we can discuss with you what deductions are available and what Fringe Benefits Tax would mean to you. It can be a complicated process, but knowing these basics will help you avoid costly errors.

So, once you’ve got your head around the potential impacts of wining and dining clients and staff, consider seeking expert advice from us to ensure you can keep having your coffees in peace.

Another informative and easy-to-digest article, thanks very much for simplifying this for us!